Deserve Credit Cards Review 2026: Best for Students & Immigrants

🎓 Best Credit Cards 2026: The Deserve Credit Card—A Gateway for Students and International Professionals

Introduction: Breaking the Credit Barrier in 2026

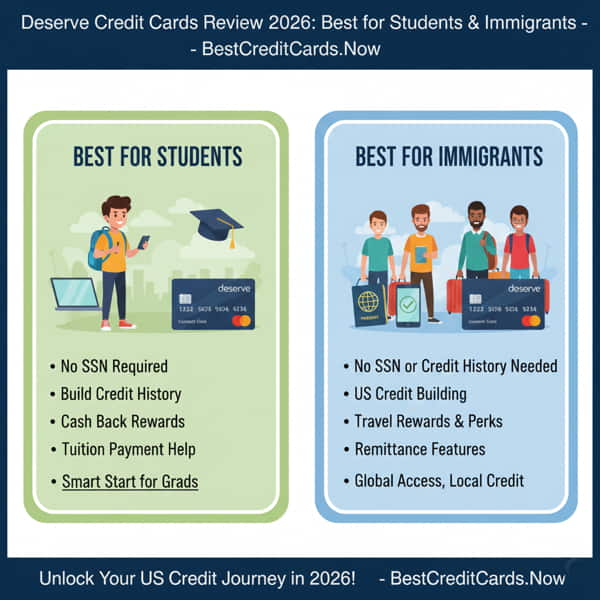

For decades, the American credit system felt like a “Catch-22”: you couldn’t get credit without a history, and you couldn’t build a history without a credit card. In 2026, while many traditional banks still cling to rigid FICO requirements, fintech innovators like Deserve have fundamentally changed the game. The Deserve credit card ecosystem is designed specifically for those who are often overlooked by the mainstream financial world—international students, immigrants, and young adults with a “thin” credit file.

As we navigate the 2026 financial landscape, Deserve stands out not just as a card issuer, but as a technology-first platform that uses “Alternative Data” to assess creditworthiness. Instead of just looking at a three-digit score, Deserve looks at your potential. Whether you are an international student arriving at a US university or a professional starting a new career path, understanding how Deserve works is essential to your financial success.

In this comprehensive review, we will explore the Deserve EDU Mastercard, the platform’s shift toward digital-first credit, and how you can use these tools to go from a credit “nobody” to a financial “somebody.”

1. The Deserve Philosophy: Beyond the FICO Score (Expertise)

1. The Deserve Philosophy: Beyond the FICO Score (Expertise)

Deserve was founded on a simple but powerful idea: a lack of credit history shouldn’t mean a lack of access. In 2026, their proprietary underwriting engine is more advanced than ever.

A. How Deserve Evaluates You

Unlike traditional banks that might reject you instantly if you lack a Social Security Number (SSN), Deserve considers:

-

Education History: Where you go to school and your major.

-

Earnings Potential: Your future income based on your field of study.

-

Banking History: How you manage your current checking and savings accounts.

This holistic approach makes it a premier choice for those following our guide on How to Get a Credit Card with No Credit History in 2026: Your Starter Guide.

B. The Shift to “Credit as a Service”

In 2026, Deserve has also become a massive platform behind the scenes, powering other “brand-name” credit cards. However, their flagship product—the Deserve EDU—remains the gold standard for students.

2. Building Credit Without an SSN (Authoritativeness)

The biggest hurdle for international students in the US is the lack of an SSN. Deserve was one of the first to solve this by allowing applications based on passport and visa information (I-20 for students).

A. Reporting to the Big Three

Even though you might start without an SSN, Deserve reports your payment history to Experian and TransUnion. Once you eventually receive an SSN, your established history is linked to it, giving you a massive head start. This is the cornerstone of our Best Credit Cards to Build Credit in 2026: Start Your Financial Journey.

B. Establishing the Foundation

By using a Deserve card responsibly, you are creating the “data trail” that future lenders need. This process is essential to unlocking the strategies found in Credit Score Unlocked: The 2026 Definitive Guide.

3. Perks and Rewards: More Than Just a Starter Card (Experience)

Deserve doesn’t just offer credit; they offer value that resonates with a younger, mobile-first demographic.

A. The Amazon Prime Student Benefit

Historically, Deserve EDU cardholders received a year of Amazon Prime Student after spending a certain amount in the first few months. In 2026, this perk continues to be a major draw for students looking to save on shipping and entertainment.

B. Cash Back and No Foreign Transaction Fees

-

Cash Back: Earn 1% cash back on all purchases, which is automatically credited to your statement. To see how this compares to high-tier cards, check our list of the Best Cash Back Credit Cards in 2026: Get Paid to Spend.

-

Travel Friendly: As you might expect from a card for international residents, there are no foreign transaction fees. This makes it an excellent companion for students traveling home for holidays, aligning with the tips in our No Foreign Transaction Fee Credit Cards for Travelers in 2026.

4. Application and Approval Strategy (Trustworthiness)

Applying for a Deserve card is a 2026-ready digital experience. Here is how to navigate it:

A. The Pre-Qualification Tool

Deserve offers a “soft pull” pre-qualification. This allows you to see if you are likely to be approved without any damage to your current credit profile. This is a vital step in modern credit hunting—read more in Credit Card Pre-Approval vs Pre-Qualification: Understanding the 2026 Difference.

B. Documentation Needed

For the best chance of approval, have these ready:

-

University name and proof of enrollment.

-

Passport and Visa documents.

-

A US-based bank account linked via Plaid or a similar secure service.

If you are denied, don’t lose heart. Review the Credit Card Application Denial Common Reasons in 2026 to see if it’s an income-to-debt ratio issue or a documentation error.

5. The Financial Reality: Fees and Interest

While Deserve is built for accessibility, it is still a financial product that requires discipline.

A. No Annual Fee

The Deserve EDU Mastercard typically has no annual fee, making it a low-cost way to maintain a long “credit age”—a key factor in your score.

B. Managing the APR

Starter cards often come with higher APRs. If you carry a balance on a Deserve card, the interest can accumulate quickly. This is why we always stress the importance of How to Use a Credit Card Responsibly for Beginners: Your Smart Start Guide. Always aim to pay your statement in full to avoid Credit Card Interest: How It Works in 2026 & How to Avoid It.

C. Security in 2026

Deserve uses advanced mobile security, including instant card freezing and biometric login. To stay even safer, follow The Best Way to Monitor Credit Card Statements for Fraud in 2026.

6. Growing Beyond Deserve: The Graduation Plan

The Deserve card is your entry ticket. But once you have 12–18 months of perfect payment history, what’s next?

-

Move to Prime Cards: Once your score hits 700+, you can apply for cards with 2% or 3% cash back or high-value travel points.

-

Leveraging for Large Loans: A solid foundation with Deserve makes it easier to qualify for auto loans or mortgages later. Check What is a Good Credit Score to Apply for a Loan in 2026?.

-

Zero to Hero: If you started with no credit, you are now well on your way through the Best Credit Cards 2026-Credit History Zero to Hero path.

Final Word: Is the Deserve Credit Card Right for You?

In 2026, the Deserve credit card remains one of the most innovative and inclusive products in the US market. It bridges the gap between international borders and financial success. If you are a student or an international resident looking to establish your American financial identity, Deserve provides the tools, the technology, and the trust you need to start your journey.

Remember, a credit card is a tool of empowerment. Use it wisely, pay it on time, and let Deserve be the “rising tide” that lifts your financial future.